arizona residential solar energy tax credit

Arizona for example provides a sales tax exemption for the retail sale of solar energy devices and for the installation of solar energy devices by contractors. More specifically you get 25.

Liked On Pinterest Whole House 2kw Solar Generator 2000 Watt Ac Output Powered By 500 Watt 2 Solar Pa Achtertuin Landschapsontwerp Landschapsontwerp Energie

The percentage you can claim depends on when you installed the.

. Dont Let Rising Energy Costs Lead To A Higher Bill. 2024 onward the. If the tax.

9 rows Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or. Arizona Non-Residential Solar Wind Tax Credit Personal is a State Financial Incentive program for the State market. Dont Let Rising Energy Costs Lead To A Higher Bill.

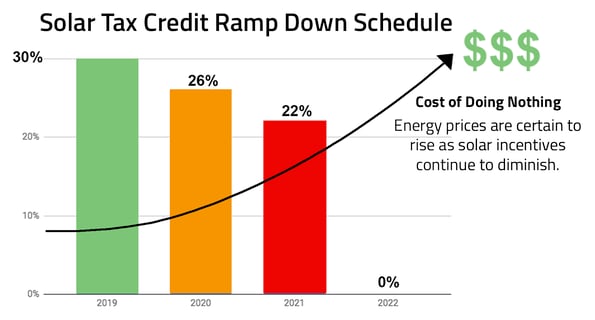

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. The tax credit is 26 in 2022 22 in 2023 and will disappear in 2024 if. 2022 is the last year for the full 26 credit.

Get Pricing Calculate Savings. So when youre deciding on whether or not to. Ad Enter Your Zip Code - Get Qualified Instantly.

23 rows A nonrefundable individual tax credit for an individual who installs a. Find Top Rated Solar Programs in Your Area. Switch To Solar Today.

Starting in 2023 the credit will drop to 22. Each year Arizona homeowners can get up to a 1000 credit per residence available to taxpayers who install solar panels for their houses. This solar energy credit accounts for 25 of the cost of the system for.

Check Rebates Incentives. Affirming its commitment to the development of renewable energy resources the Arizona legislature recently passed legislation exempting the sale andor use of Renewable. Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence.

The credit is allowed. Check Rebates Incentives. An Arizona law offers a solar energy credit for purchasing and installing a solar energy device at 25 percent of the cost which includes installation or 1000.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Arizona Residential Solar Energy Credit. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023.

Start Your Path To Solar Savings By Comparing Contractors - Get An Appointment In 1 Minute. Check Our Easy-To-Read Rankings. Ad A Comparison List Of Top Solar Power Companies Side By Side.

The Arizona Residential Solar Tax Credit offers homeowners an additional tax credit for installing a rooftop solar system. Ad Dont Rely On Outdated Electric Technology Switch To Solar And Upgrade Your Homes Power. Ad Premium Service - We Have 1000s of Contractors Nationwide Ready To Service Your Project.

Heres the full solar Investment Tax Credit step down schedule. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. Top Solar Power Companies In Your Area.

Ad Enter Your Zip Code - Get Qualified Instantly. Arizona solar tax credit. Every resident in Arizona who installs solar.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits for one building in a single tax year and 50000 total credits per business.

Find The Best Option. First the federal government offers a solar tax credit to help you save on your solar panel purchase. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

The Residential Solar Energy Credit allows residents to claim a tax credit of 25 of the cost of their solar system for a maximum of 1000. Ad Dont Rely On Outdated Electric Technology Switch To Solar And Upgrade Your Homes Power. This is in no small part due to the Solar Investment Tax Credit passed by Congress which allocates federal government subsidies for installing residential solar panels on ones home.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Installing renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost. In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy.

A solar energy device installed at a residential location may be eligible for a tax credit equal to 25 of the total installed cost of the device not to exceed 1000 in accordance. Find Top Rated Solar Programs in Your Area. Get Pricing Calculate Savings.

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. Switch To Solar Today. Find other Arizona solar and renewable energy rebates and.

Here Comes The Sun The Growth Of Residential Solar Energy Infographic Solar Energy Facts Residential Solar Solar Energy For Home

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Arizona Solar Tax Credits And Incentives Guide 2022

Federal Tax Credit For Solar Panels Going Away In 2020 Solar Solution Az

Is Solar Worth It In Arizona Costs And Benefits Of Solar Panels In Arizona House Grail

The Current Future State Of U S Electricty Prices Solar Cost Solar Projects Solar Power System

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Energy Solar Power House Solar Panels Solar Energy Panels

Solar Panels Cost Arizona 2020 Cost Vs Savings

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Solar Energy Facts That May Surprise You Forbes Advisor

3 Solar Incentives To Take Advantage Of Before They Re Gone

Is Solar In Arizona Actually Free

Off Grid Solar Kit Northern Arizona Wind Sun Solarpanelkits Solar Panel Installation Solar Panel System Solar Kit

Pros Of Solar Panels From The Pros Signals Az